Header image courtesy of Dominic Chavez/World Bank

The need for renewable energy has intensified as the globe grapples with climate change. Rural areas are part of this push, even though they present unique challenges such as lower population densities and logistical complexities. However, these rural areas can achieve renewable energy goals given innovative financing models, which the rest of this article explores.

What is the current state of renewable energy financing in rural settings?

Renewable energy faces some challenges in rural areas. These include a lack of infrastructure, financing, skills, and public awareness. Renewable energy projects must also work around the lack of grid connectivity and higher per-unit energy costs.

Traditional financing models often do not address the unique needs of renewable energy in rural areas. As such, innovative financing is needed to overcome the barriers of high upfront costs, high perceived risks, and small project sizes, which could discourage traditional bankers and financiers. This is needed to make renewable energy accessible and affordable for rural communities.

Case studies of innovative financing models for rural renewable energy projects

Crowdfunding and community financing schemes

These types of financing allow individuals and communities to invest directly in local renewable projects. They can help solve the problems of lack of access to capital, high upfront costs, and long payback periods. They also increase local ownership and engagement.

An example of these financing models is the Ambition Lawrence Weston renewable energy project, which planned for a giant wind turbine that can power 3,850 homes and generate up to £400,000 per year in profit.

Green bonds

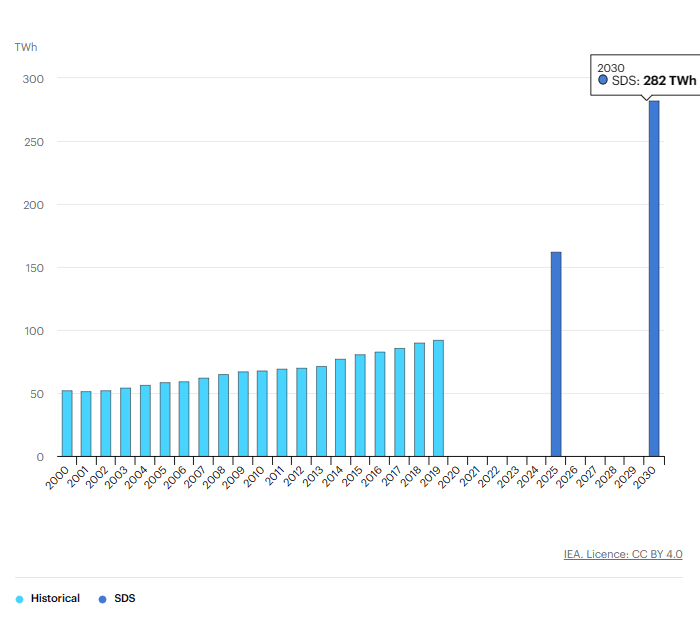

Green bonds are another means of financing rural renewable projects, with cumulative issuance crossing the US$1 trillion mark in 2020. Apart from providing access to capital, they also attract investors interested in supporting the transition to a low-carbon and climate-resilient economy.

Pay-as-you-go (PAYG)

PAYG models provide affordable and flexible payment options for renewable energy products, such as solar home systems and mini-grids. Customers can pay for their energy use in small instalments instead of bearing the burden of a high upfront payment.

Advantages of PAYG models in rural renewable projects include reducing the risk of default and theft for the energy providers, enhancing the quality and reliability of renewable energy services through customer support, maintenance, and warranty, and generating local employment and entrepreneurship opportunities by involving local agents and distributors.

Power purchase agreements

Power purchase agreements (PPAs) are contracts between a power generator and the party that wants to buy the power. The agreements cover an agreed period, with the power supply set to meet the requirements of the generator and the buyer.

PPAs can provide a means for farmers and landowners in rural areas to sell excess renewable energy generated on their properties. These have the potential to incentivize the adoption of renewable energy and provide a stable secondary income for rural dwellers.

Conclusion

Innovative financing models are crucial in driving the adoption of renewable energy in rural areas. Businesses, investors, and policymakers must tap into these innovations to extend the benefits of renewable energy to every corner of the planet.